Note: Since many of our projects have used historic tax credits as a funding source, we wanted to share what we know about “HTCs” so that you can consider them for your next project. You’ll find a number of benefits, along with answers to some frequently asked questions, below. For inspiration, take a look at some of our projects that have successfully leveraged historic tax credits.

Throughout the country, thousands of historic buildings have become successful renovation projects thanks to a critical financial tool: Historic Tax Credits. Historic Tax Credits, or, “HTCs”, as we often call them, have helped turn liabilities into assets, eyesores into landmarks, and forgotten places into memorable destinations.

Company 251: Before

Company 251: After. Learn more about this project here.

It would be difficult for us to overstate how beneficial historic tax credits can be for your renovation project. We have seen HTCs make the difference on a wide range of projects, from main street buildings to iconic landmarks, and we can say with confidence that the historic tax credits are nothing short of transformative. Here’s how:

HTCs transform the numbers, taking projects from being ‘non-starters’ or even stalled projects to completed projects.

HTCs transform the building itself, taking buildings with years (sometimes decades!) of deferred maintenance and making them into destinations in which folks open new businesses, start new activities, or find a new place to call home.

HTCs transform narratives. Our old buildings embody the history of our communities, of course, and this is conveyed through the stories we tell. When a building is shuttered or demolished, a piece of your community’s story simply comes to an end. Our favorite stories are the ones that continue to be written, with memories of old buildings being kept alive through new and exciting uses.

Prairie Street Brewhouse: Before

Prairie Street Brewhouse: After. Learn more about this project here.

Why You Should Consider Historic Tax Credits

If you’re here, there’s a good chance you own an old building and are considering undertaking a renovation project of your own. So let’s talk about how historic tax credits can be beneficial to your project.

They close the gap. When the budget is tight, historic tax credits can make the project financially feasible, allowing it to move forward.

They reduce the risk. Adding historic tax credits to the capital stack lessens the need for personal equity and the overall loan amount. Instead of having to leverage personal equity to make the project doable in the eyes of the bank, that equity can be split by bringing in the historic tax credits. Other investors now have good reason to enter the project and support it because of the benefit of the tax credits that they receive.

They pair well. Historic tax credits are compatible with most other incentives. This means your project can receive HTCs without jeopardizing the ability to receive other incentives like tax increment financing and facade improvement programs.

They’re versatile. You can claim the credit for yourself to reduce tax liability, or bring on a partner who can use them instead.

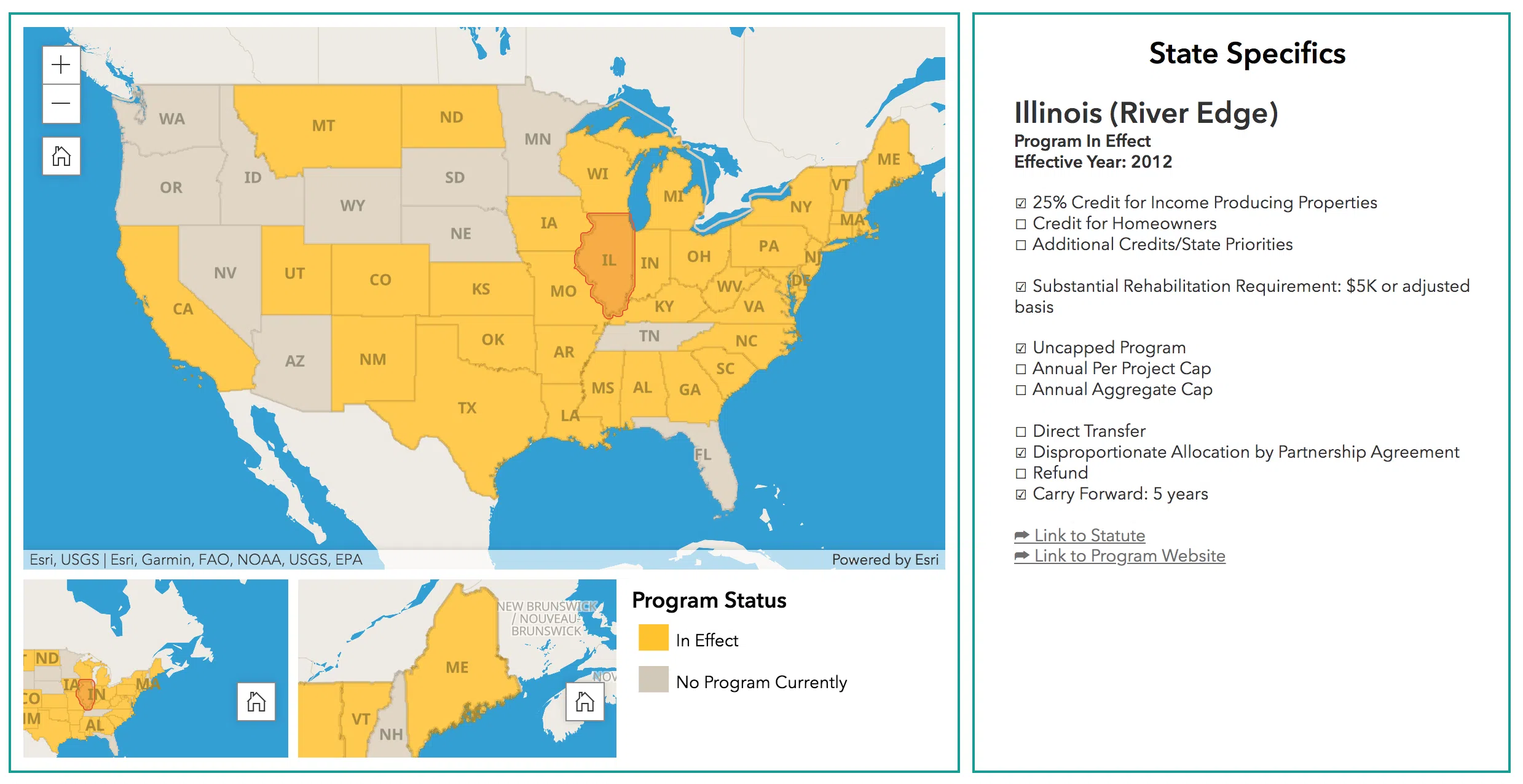

There are two types of historic tax credits, state and federal, and both are a credit on income tax. Many states have a tax credit ranging anywhere from 15-25%, and the federal tax credit is 20%. Put them together, and you’re looking at a large percentage of project costs being eligible for HTCs.

The National Trust for Historic Preservation has created an easy-to-use mapping tool to help users learn more about each state’s historic tax credit program. Learn more here.

HTC FAQs

Perhaps you’re already aware of, and on board with, using historic tax credits for your project. “It’s clear that they work…but will they work for my project?”, you might ask. We’ve found that the following questions are helpful in the vetting process:

Is my building eligible?

In most states the building must either be individually listed on the National Register of Historic Places, considered a contributing building within a National Register Historic District, or be a district certified by the National Park Service for the purposes of this program.

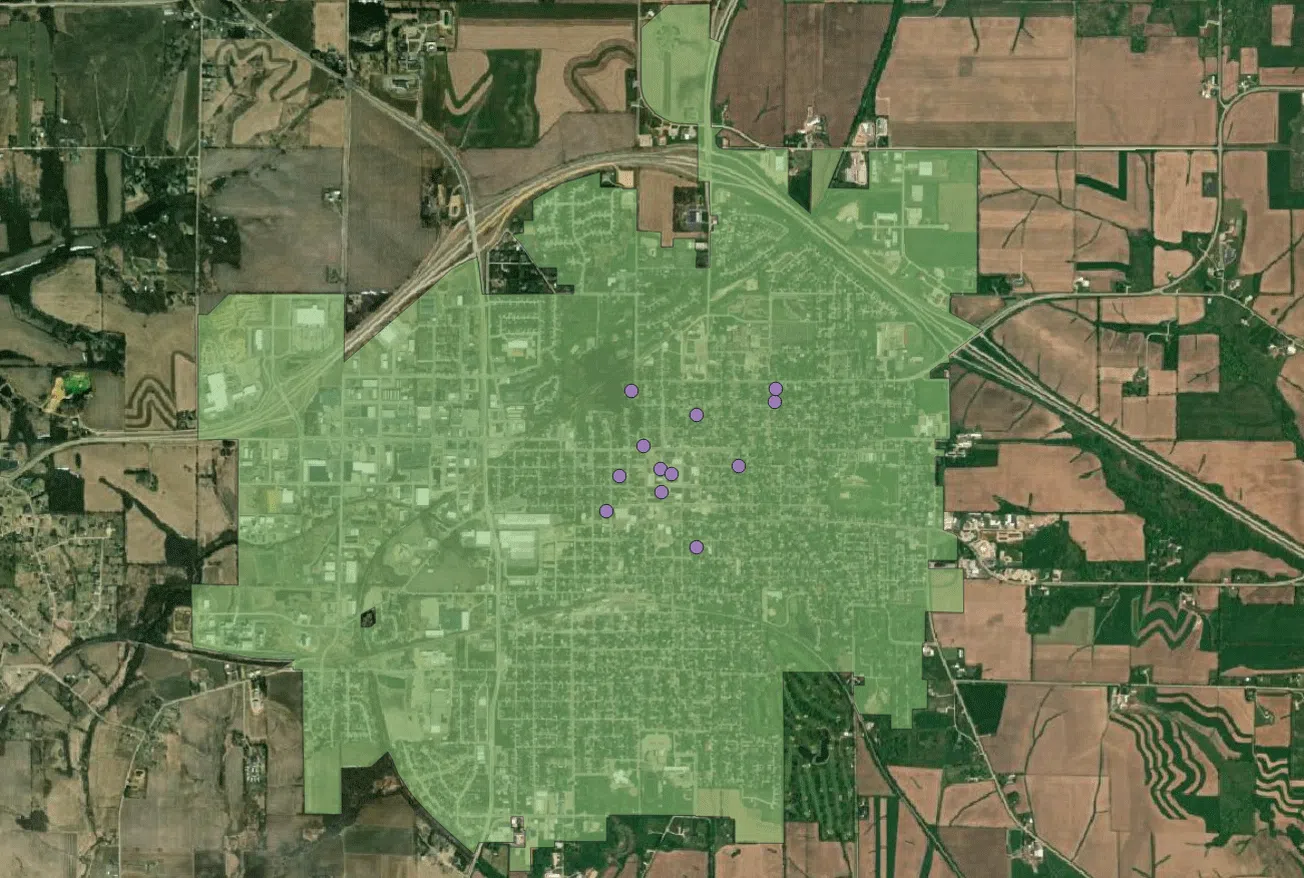

The purple points indicate the buildings in Monroe, Wisconsin that are listed on the National Register of Historic Places: 12 total.

The Monroe Commercial District in Monroe, Wisconsin. The yellow points indicate the contributing buildings within the district (79 total), which are eligible for Historic Tax Credits.

What are the program requirements?

The project must follow standards developed by the Secretary of the Interior. This applies to both exterior and interior work. The property must have an income-producing use once it’s been redeveloped, such as a restaurant, apartment, or an event space. And, you’ll need to spend enough on the rehabilitation. This program is for major renovations rather than for small repair projects.

A 1927 building, originally used as a Ford automotive dealership and garage…

Undergoes a sustantial rehabilitation…

For an income-producing use: The Lock & Mule. Learn more here.

Finally, we recommend that the work for the project be approved before the project begins by both the State Historic Preservation Office and National Park Service so you don’t risk losing the tax credits. While some activities can occur prior to approval (e.g. selective demolition), this should only be done in close consultation with your architect and historic tax credit consultant.

What Expenditures Qualify for Historic Tax Credits?

Historic tax credits can be applied to hard costs, like demolition and construction within the building envelope, and soft costs like legal fees, architectural and engineering fees, the developer fee, and more.

What difference would historic tax credits make toward the cost of a typical project?

Great question! Let’s say your project is located in Illinois and has a total development cost of $2.5 million, $2 million of which includes qualified expenses. Of that $2 million, your project could receive up to $900 thousand total in HTCs: $500 thousand in state credits, and $400 thousand in federal credits.

The historic tax credits cannot be applied to every expense. Costs related to buying the building, additions such as rooftop decks, and non-fixed items like furniture do not qualify. But with the tax credits covering a good portion of project costs, you can see how this can become a viable financial tool.

These images illustrate some of the Qualified Rehabilitation Expenses at the Old McHenry County Courthouse. Learn more here.

Windows, doors, and floors can all be rehabilitation expenses. Furniture, however, is not.

Rooftop decks are not considered a Qualified Rehabilitation Expense. They are quite lovely, though!

What if the historic tax credits DON’T make a difference?

When it comes to historic tax credits, two key risks come to mind. The first is not receiving HTCs for your project. This could happen for a number of reasons, such as not following the Standards for Rehabilitation during any phase of the project (e.g. demolition) as described above, or not having a competitive application depending on your state’s program. The second is the risk of not attaining a sufficient return on your investment, even with the tax credits added to the capital stack. You may have a target return in mind, say, 6 percent, and a 3 percent return with HTCs in the stack may not be worthwhile for you.

Building the Dream Team for Your Project

Historic tax credits could be a critical financial tool for your project, but are often difficult to navigate. So if you’re considering bringing new life to an old building, we strongly encourage you to partner with an architect and historic tax credit consultant as soon as possible to ensure your project is (and remains) eligible for historic tax credits.

Bringing on an architect with preservation and adaptive reuse experience early in the project allows you to get context-sensitive approaches that pay respect to the historic details and methods present in your building.

Bringing on an historic tax credit consultant early in the project brings a much-needed eye for ensuring critical details remain intact so as to meet the Standards for Rehabilitation.

Architects + Tax Credit Consultants: All Under One Roof

At Studio GWA we’ve been fortunate to work with clients for over four decades on historic renovation projects. Our team of historic tax credit consultants, architects, and designers makes us a one-stop shop for navigating every phase of your project including the first: Making sure it’s financially feasible.

Let’s Discuss Your Project!